Middle Housing Is Expanding in Washington and Arizona—But That Doesn’t Mean Your Land Value Automatically Doubles

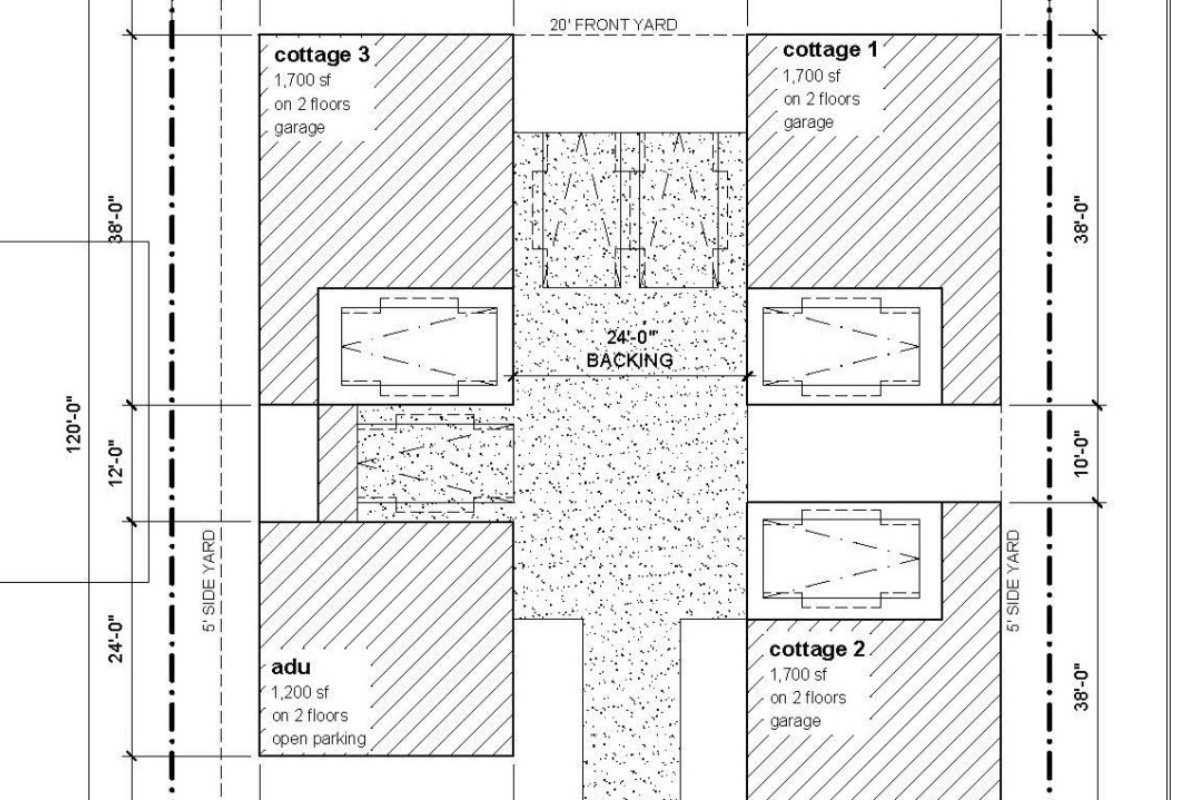

Washington State and Arizona have both rolled out major zoning changes that open the door to more middle‑housing options—duplexes, triplexes, fourplexes, cottage clusters, and other small‑scale multifamily homes that fit into existing neighborhoods.

These reforms are exciting. They create new possibilities for homeowners, builders, and communities. But they’ve also created a wave of confusion—especially the idea floating around that “your land just doubled in value overnight.”

It’s a catchy line. It’s also not how land valuation works.

I’ve been working in infill development and middle‑housing strategies since 2006, long before these zoning headlines started trending. And every time zoning expands, the same pattern shows up: big expectations, big assumptions, and a lot of misinformation. The rules may change, but the fundamentals of land value don’t.

This is exactly why sellers need a true land specialist—not a wholesaler chasing a quick assignment fee.

Zoning Changes Create Possibility—Not Guaranteed Profit

Washington’s HB 1110 and Arizona’s middle‑housing initiatives are designed to allow more housing types. But zoning alone doesn’t determine value.

A zoning change simply means you’re permitted to build more. Whether you can build more—and whether it actually pencils for a builder—depends entirely on the site.

Every parcel is different. And every parcel needs to be evaluated through feasibility, not hype.

Some of the factors that matter:

- Lot size, shape, and access

- Utility availability and capacity

- Topography, slopes, and critical areas

- Stormwater requirements

- Parking and access constraints

- Construction costs and builder appetite

- Local absorption rates and exit values

- Financing conditions and DSCR constraints

Two lots with the same zoning can have completely different values once feasibility is done. Builders don’t buy zoning—they buy buildable yield. And yield has to be proven, not assumed.

Why Middle Housing Doesn’t Automatically Double Land Value

Even if your property can support more units, that doesn’t mean the market will pay double. Here’s why:

1. Builders run pro formas, not emotions

They look at construction costs, interest rates, absorption, and exit values. If the numbers don’t work, they walk.

2. More units often mean more infrastructure costs

Stormwater, utilities, and site prep can jump significantly with added density.

3. Financing conditions matter

Higher rates and tighter lending standards directly affect what builders can pay.

4. Not all middle‑housing types pencil the same way

A fourplex might be profitable on one site and completely unworkable on another.

5. Markets take time to adjust

Washington and Arizona are still early in their middle‑housing transitions. Values shift gradually—not overnight.

Zoning creates opportunity. Feasibility creates value.

Wholesalers Are Targeting Sellers—And That’s a Problem

Whenever zoning expands, wholesalers rush in with:

- Cash offers” that sound high but are actually low

- Assignable contracts they flip without ever closing

- Pressure tactics to sign quickly

- No feasibility analysis

- No transparency

- No accountability

Their profit comes from the gap between what you know and what builders know.

They’re not analyzing your site.

They’re not investing in your community.

They’re not closing on your land.

They’re simply selling your contract to someone else for a markup.

And that markup should have been yours.

Why You Need an Infill Specialist—Not a Wholesaler

Middle housing isn’t new to us. We’ve been executing infill and small‑scale development strategies successfully since 2006—long before these zoning changes made headlines.

A true infill land specialist brings what wholesalers can’t:

1. Real feasibility analysis We evaluate your property the same way a builder does—yield, utilities, zoning, topography, and regulatory constraints.

2. Builder matchmaking Not every builder is right for every site. We know who can execute, who pays the strongest numbers, and who has the track record to close.

3. Deep experience with middle housing This isn’t new for us. Washington and Arizona’s zoning changes simply expand the toolkit we’ve been using for nearly two decades.

4. Protection from predatory offers We ground you in real numbers so you don’t fall for inflated promises or quick‑flip tactics.

5. Maximized value for your land Your property is often your largest asset. You deserve a strategy—not a shortcut.

The Bottom Line

Middle housing is expanding. Zoning is evolving. Opportunities are growing in both Washington and Arizona. But land value isn’t determined by headlines or assumptions. It’s determined by feasibility, builder demand, and real market conditions.

If you want to understand what your property is truly worth—and avoid leaving money on the table—you need an infill specialist like The Sunny Company Real Estate who has been doing this work long before middle housing became the hype!