How Middle Housing Really Works — And What Our Outlier East of Market Kirkland Project Proves About Real Land Value

Middle housing is reshaping what’s possible for homeowners across Washington and Arizona.

Duplexes, triplexes, cottage clusters, ADUs, and DADUs have expanded what can be built on a single parcel and opened the door to entirely new buyer pools.

But with that excitement has come a wave of misinformation — especially the belief that:

“Middle housing doubles your land value overnight.”

It doesn’t.

And our recent Outlier Project in Kirkland’s East of Market neighborhood is a perfect real-world example of what actually happens when zoning reform meets true feasibility analysis and the right builder match.

At The Sunny Company Real Estate, we’ve been executing infill and middle-housing strategies since 2006. We’ve lived through every market cycle, zoning shift, and trend — and the truth is simple.

Middle Housing 101: What It Actually Does

Middle housing changes possibility, not guarantees.

Here’s what it really does:

1. It Increases Potential Density — Not Guaranteed Density

Zoning may allow more units, but feasibility determines what can actually be built and sold.

2. It Shifts Value Toward Yield — Not Hype

Builders don’t buy zoning.

Builders buy buildable yield — the real product they can deliver to the market.

3. It Gives Homeowners More Exit Strategies

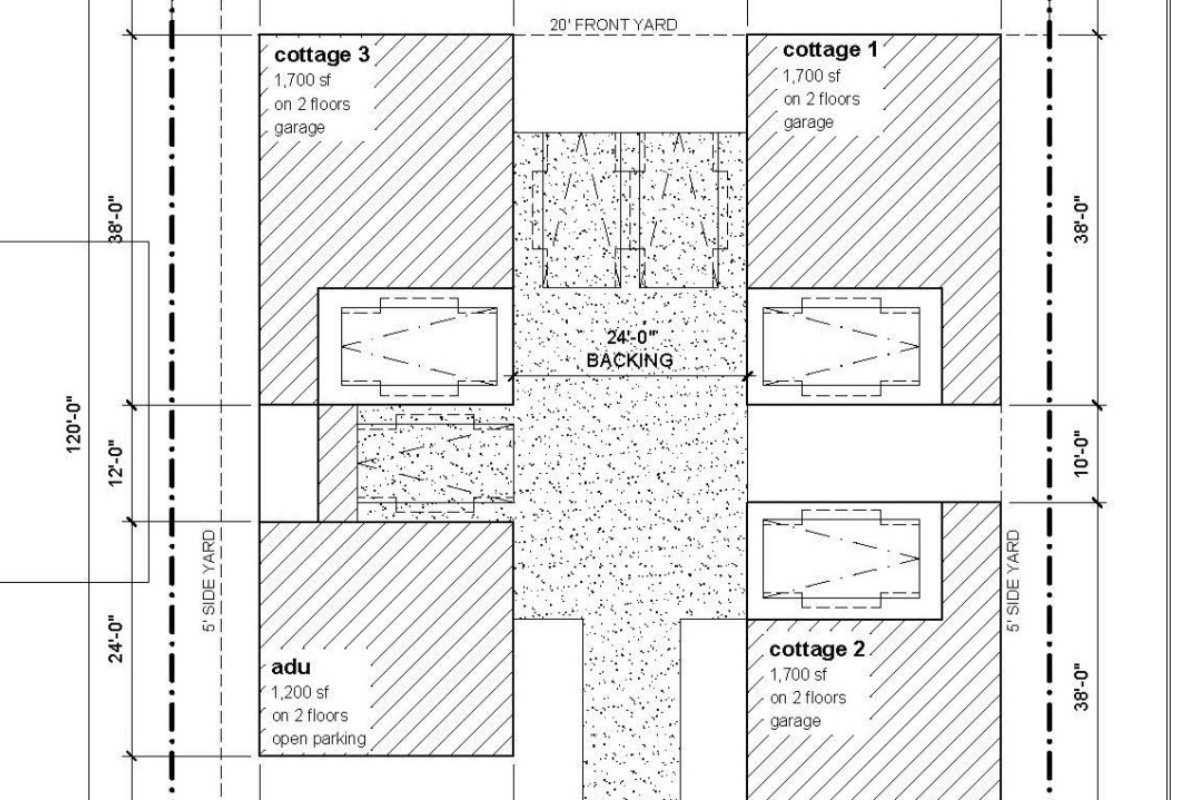

A parcel that once supported only one home may now support:

- A single home + ADU

- A single home + ADU + DADU

- A duplex

- A triplex

- A cottage cluster

But the highest value comes from matching the right builder to the right site, not from assuming more units automatically mean more money.

A Real Example: The Outlier East of Market Project

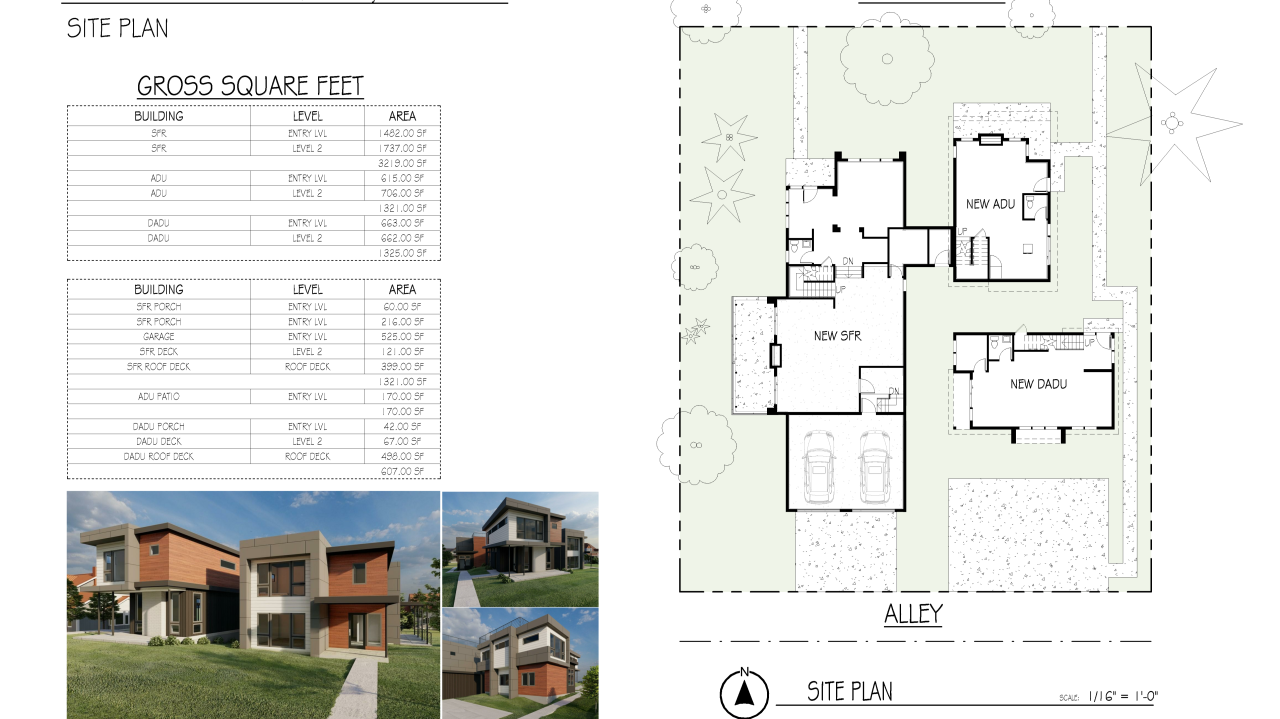

For this project, we:

- Sourced the land

- Ran full feasibility

- Matched the site with the right builder

The result:

One premium single-family home plus two smaller homes (an ADU and a DADU).

This project clearly shows the true math of middle housing.

What Most People Miss

- Each smaller home (the ADU and DADU) sold for roughly half of what the main home sold for

- The ADU + DADU had approximately the same combined square footage as the main home

- Their combined value equaled the value of a true standalone single-family home

- The single-family home carried only a slight premium — not double

This proves three critical truths:

- Buyers pay for lifestyle fit, not just square footage

- Middle housing adds value, but it does not replace the premium single-family market

- Highest and best use is determined by buyer demand, not unit count

Outlier Project Sales Comps (Actual Closed Data)

From the same micro-pocket on 10th Ave:

- Main single-family home: $3.2M

- ADU: $1.54M

- DADU: $1.405M

- ADU + DADU combined: $2.945M

Key insight:

- Combined square footage of the ADU + DADU ≈ main home

- Combined value of the ADU + DADU ≈ main home

Not double. Not half. The same value band.

This is the real-world math sellers need to see.

Why Middle Housing Works: It Expands the Buyer Pool

The biggest misconception about middle housing is that its value comes from “more doors.”

That’s not the real story.

The real power of middle housing is buyer pool expansion.

1. The $5M Buyer Pool Is Small

In Norkirk, new construction single-family homes trade between $2.8M and $5.4M.

These homes are beautiful — but the buyer pool at that level is limited. Only a small number of households can comfortably purchase a $4M–$5M home.

This is why feasibility and builder matching matter. The highest value use isn’t always the most expensive product.

2. Middle Housing Unlocks the $1.5M Buyer Pool

The ADU and DADU sold around $1.5M, a price point with far more qualified buyers.

And importantly — these were not investors.

They were:

- Long-time neighborhood residents

- Downsizers wanting to stay close to family

- Buyers prioritizing walkability and lifestyle

- Households wanting new construction without large-home maintenance

Middle housing gave them a way to stay in the neighborhood they love — at a price point that made sense.

Without it, they would have been priced out entirely.

3. The $3M Buyer Pool Attracts Younger Families

The main home sold around $3M, attracting:

- Younger families

- Dual-income professionals

- Move-up buyers

- Buyers looking for long-term roots

Middle housing didn’t replace the single-family buyer.

It added two additional buyer pools beneath it.

The Most Important Insight: Same Square Footage = Same Value Band

This is what sellers need to understand:

The ADU + DADU had the same combined square footage as the main single-family home — and sold for roughly the same combined value.

Not more.

Not less.

The same value band.

This pattern shows up again and again in infill neighborhoods:

- Two smaller homes together ≈ value of one true standalone single-family home

- The single-family home carries only a slight premium

- Middle housing doesn’t inflate land value — it redistributes value across multiple products

Why?

Because each product serves a different buyer:

- Downsizers value low maintenance and walkability

- Younger families value privacy and yard space

Both will pay for new construction — just at different price points.

Middle housing doesn’t dilute value.

It balances absorption across multiple price tiers.

That’s the real magic.

True New Construction Single-Family Comps in Norkirk

Here are actual standalone, non-ADU new construction sales builders model pro formas around:

- 1813 3rd St — $5,390,000 — 6,072 sq ft

- 10661 Forbes Creek Dr — $2,795,000 — 3,600 sq ft

- 12127 NE 65th St — $3,498,000 — 4,197 sq ft

- 5515 108th Ave NE — $4,500,000 — 5,000 sq ft

- 912 18th Ave W — $3,998,000 — 4,315 sq ft

These homes set land value — and they reinforce the same conclusion.

The Bottom Line

Middle housing is a powerful tool — but it’s not a magic wand.

Your land value is determined by:

- Feasibility

- Builder demand

- Market absorption

- Exit values

- Strategy

At The Sunny Company Real Estate, we’ve been executing these strategies since 2006.

We don’t guess.

We don’t hype.

We analyze, match, and deliver.

If you want to understand what your land is truly worth — and how middle housing applies to your specific parcel — we’re here to walk you through it with transparency and expertise.